In the latest of our quarterly updates, we use our unique, national dataset to look at the key trends in the independent healthcare sector up to, and including, the end of 2023 in Scotland. The data covers private healthcare in-patient/day-case market activity, insured cases, ‘self-pay’, along with national/regional and procedural breakdowns and demographic information. (Q1 = Jan – Mar; Q2 = Apr – Jun; Q3 = Jul – Sep; Q4 Oct – Dec)

Private healthcare sector market activity

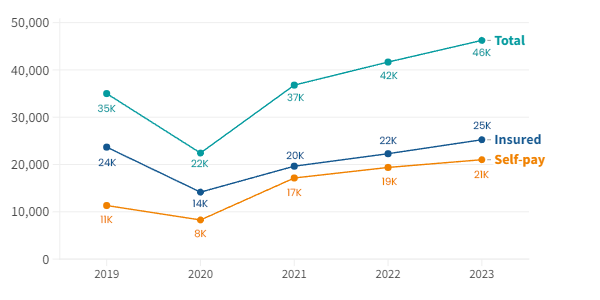

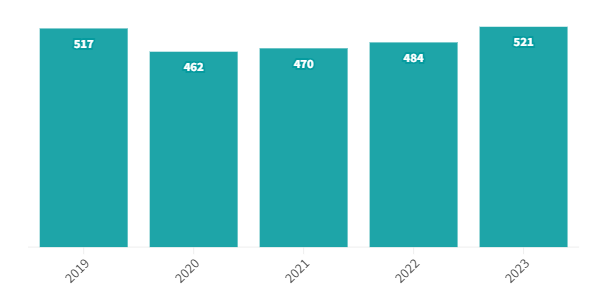

Private hospital admissions by year 2019-2023

Scotland - At a glance

2023 v 2022:

- Total private admissions up 11%.

- Self-pay admissions up 8% and at highest level ever.

- Private medical insurance admissions up 13% and also at record levels.

- Third year in a row that admissions are at above pre-pandemic levels.

- First time Insured admissions have been higher than pre-pandemic levels.

2023 v 2019

- Total private admissions up 32%.

- Self-pay admissions up 86%

- Insured admissions up 7%

Record independent healthcare in-patient admissions in 2023

The total number of private hospital admissions in Scotland was 46,000 (11% above 2022) meaning the private sector had more admissions than in any previous year on record.

Admissions in Q4 2023 were 6% above the equivalent quarter in 2022, with self-pay admissions up 4% and insured admissions up 8%.

Self-pay admissions were at their highest ever levels in Q2 2023, but have declined slowly since, although they remain above the equivalent quarters in previous years.

Self-pay admissions in Q4 in 2023 were 75% higher than in Q4 2019.

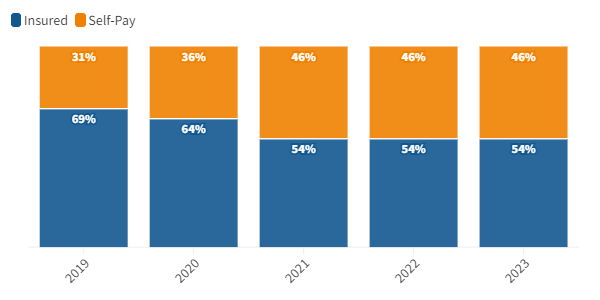

Private medical insurance and self-pay admissions at record annual levels

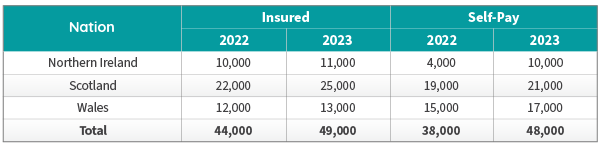

Self-pay continued to grow in all the devolved nations in 2023: Northern Ireland (144%), Scotland (8%) and Wales (11%) were all above 2022 figures.

Admissions by Devolved Nation by payment method

Proportion of Insured vs Self-pay admissions in Scotland

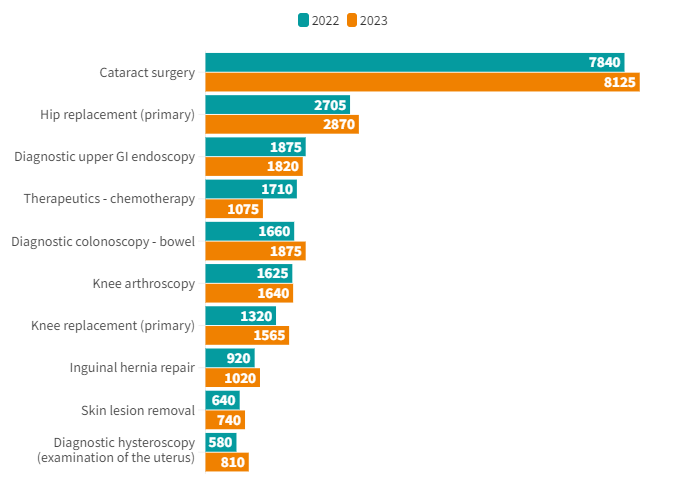

Top 10 procedures (2022 v 2023)

The biggest increases by volume in admissions in the Top 10 procedures were for ‘Cataract surgery’. These increased by 285 (4%). The next biggest volume increase was in ‘Knee replacement (Primary)’ at 245 (19%).

The biggest increase by percentage was ‘Diagnostic hysteroscopy (examination of the uterus)’ at 40%.

The biggest decrease by volume (-635) and percentage (-37%) was ‘Therapeutics – chemotherapy’. Individual patients will have a varying number of admissions for this treatment depending on the type and the stage of cancer they are being treated for. This means this procedure can vary more than those which are more likely to have one patient per admission.

Active consultants in private healthcare by year

The number of consultants active in private healthcare regularly fluctuates as new ones start and others leave the profession. However, the number of active consultants in Scotland has grown in the past two years and was at the highest level since records began in 2023.

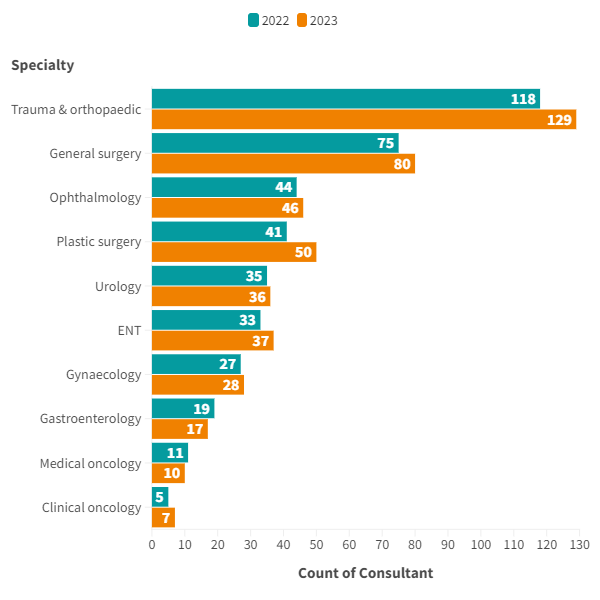

Comparison of active consultants for the top 10 PHIN specialties (2022 v 2023)

The largest increase by volume in active consultants in the top 10 procedure groups was in ‘Trauma & orthopaedics’ with an extra 11 consultants (9%). Clinical Oncology had the largest percentage increase (40%), but this was only an additional 2 consultants.

Two procedures, ‘Gastroenterology’ (-11%) and ‘Medical oncology’ (-9%) had fewer active consultants than in 2022.

Patient demographics

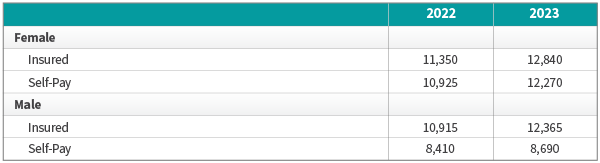

Volume of admissions by sex and payment method

There was an increased number of insured admissions and self-pay admissions for both sexes in 2023 compared to 2022.

Insured admissions were up equally for both sexes at 13% compared to 2022.

The increase for self-pay funded admissions was larger for females (12%) than for male admissions (3%).

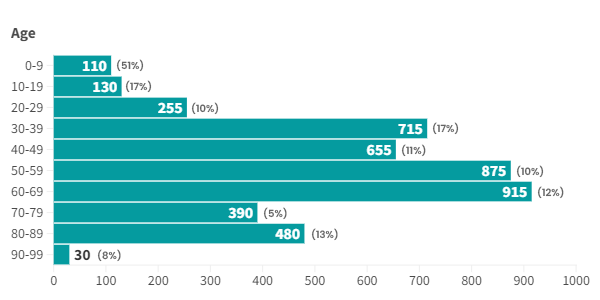

Volume of admissions by age

There was an increase in admissions in all age groups in 2023 compared to the previous year. The largest percentage increases were in the 0-9 (51%) and 80-89 (13%) age groups.

The most common age group for private admissions was 50-59 (875 admissions) and 60-69 (915 admissions).

Private admissions by age group

Important notes

All data described above taken from PHIN’s unique, national private dataset describing discharge activity (day case and inpatient). This excludes activity outside of PHIN’s mandate from the Competition and Markets Authority, such as outpatient diagnostics, physiotherapy and mental health services.

There is a time lag between collecting, validating and processing the data we receive from hospitals before we can publish it. This can be up to 6 months after treatment has been completed, to ensure a fair process and accurate data.

Activity numbers have been rounded to the nearest 5, with percentage based on the unrounded figures.