In the latest of our quarterly updates, we use our unique, national dataset to look at the key trends in the independent healthcare sector up to, and including, the end of 2023 in Northern Ireland. The data covers private healthcare in-patient/day-case market activity, insured cases, ‘self-pay’, along with procedural breakdowns and demographic information. (Q1 = Jan – Mar; Q2 = Apr – Jun; Q3 = Jul – Sep; Q4 Oct – Dec)

Private healthcare sector market activity

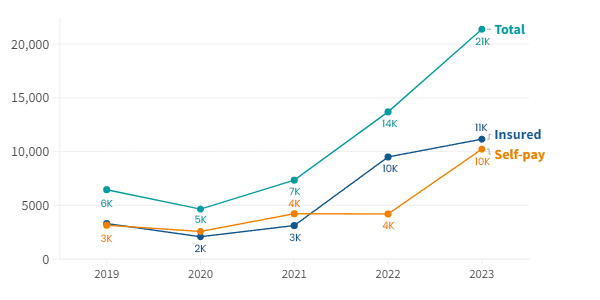

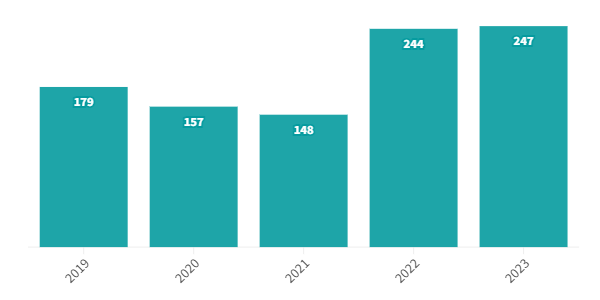

Private hospital admissions by year 2019-2023

Northern Ireland: At a glance

2023 v 2022:

- 21,000 private hospital admissions.

- Private admissions up 56%.

- Self-pay admissions up 144% to 10,000 and at highest level ever.

- Private medical insurance admissions up 17% to 11,000 and at highest level ever.

- 60-69 and 70-79 age groups had the most private admissions.

2023 v 2019

- Private admissions up 250%.

- Self-pay up 225%.

- Insured admissions up 238%.

Record independent healthcare in-patient admissions in 2023

The total number of admissions in Northern Ireland in 2023 was 21,000 (56% above 2022) meaning the private sector had more admissions than in any previous year on record.

Quarter 4 2023 was 50% above the equivalent quarter in 2022, with both self-pay and insured admissions reaching record levels.

Some of this rise may be due to more complete data submission by the hospital groups in Northern Ireland to PHIN, meaning there is now a more accurate picture of activity.

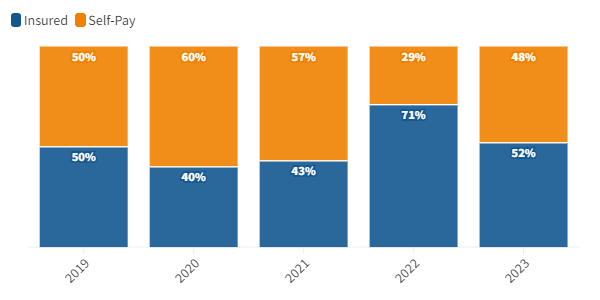

Insured and Self-Pay Proportions

Before the pandemic (2019), payment for private treatment in Northern Ireland was split equally between insured and self-pay.

In the following two years, self-pay became more popular, but then in 2022 Insured admissions reached their highest level ever (71%).

In 2023, the proportion of Insured admissions reduced, but it was still the most popular way of paying.

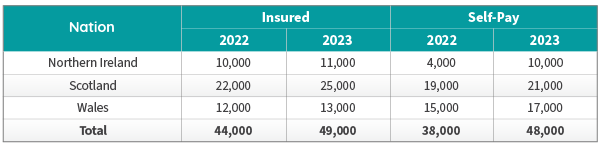

Private medical insurance and self-pay admissions at record annual levels

Self-pay continued to grow in all the devolved nations in 2023: Northern Ireland (144%), Scotland (8%) and Wales (11%) were all above 2022 figures.

Admissions by Devolved Nation by payment method

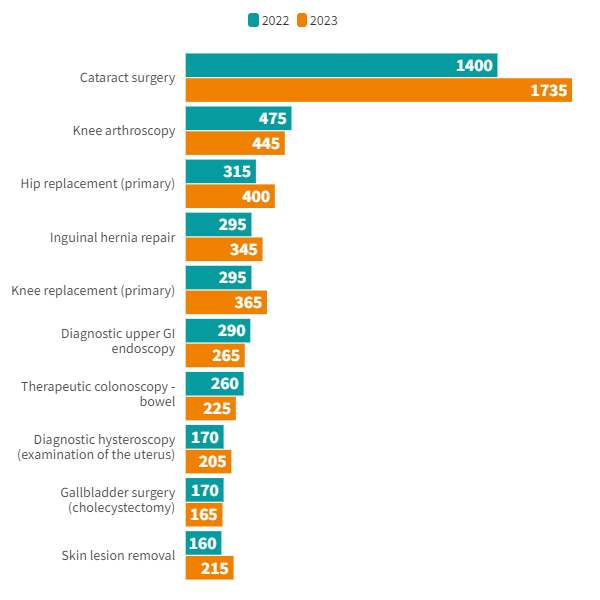

Top 10 procedures (2022 v 2023)

In 2023, the biggest increases by volume in admissions in the Top 10 procedures were for ‘Cataract surgery’ which had 335 (24%) more admissions. ‘Hip replacement (Primary) was up 85 (27%) and ‘Knee replacement’ up 70 (24%) admissions.

Skin legion removal had the highest percentage growth (34%) up 55 admissions.

The biggest decrease was in ‘Therapeutic colonoscopy – bowel’ which was down 35 (14%) admissions.

Market trends from 2022 to 2023

When looking beyond just the Top 10 procedures, there was a 425% increase in ‘Eye lifts for cosmetic’ purposes (blepharoplasty) but a fall (-42%) in admissions for ‘Carpal tunnel release’.

Active consultants in private healthcare by year

The number of consultants active in private healthcare regularly fluctuates as new ones start and others leave the profession. However, the number of active consultants in Northern Ireland has grown in the past two years and was at the highest level since records began in 2023. The total was 38% higher than in 2019.

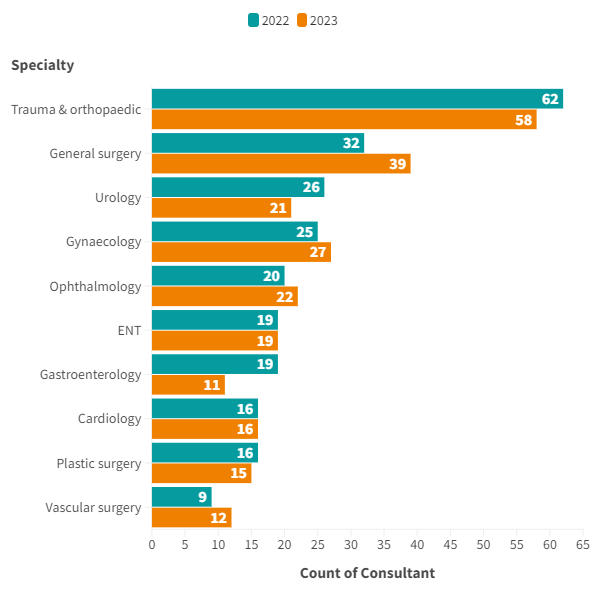

Comparison of active consultants for the top 10 PHIN specialties (2022 v 2023)

The largest increase in active consultants in the top 10 procedure groups was in ‘General surgery’ which had an extra 7 consultants.

‘Gastroenterology’ saw the biggest decline in active consultants with 8 less than in 2022.

Patient demographics

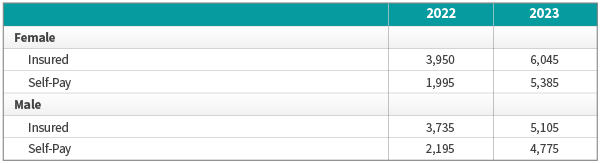

Volume of admissions by sex and payment method

There was an increased number of insured admissions and self-pay admissions for both sexes in 2023 compared to 2022.

There was a higher number of admissions paid for with private medical insurance for females (up 53%) compared to males (up 37%).

The increase for both sexes was greater for self-pay admissions: females (170%) and males (118%) in 2023.

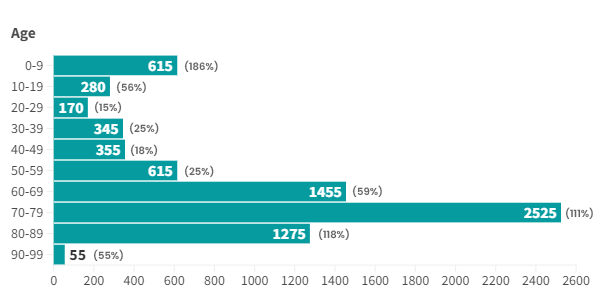

Volume of admissions by age

There was a percentage increase in admissions in all age groups in 2023 compared to the previous year.

The largest percentage increases were in the 0-9 (186%), 70-79 (111%) and 80-89 (118%) age groups.

The 60-69 and 70-79 age groups had the largest volume of admissions. This is older than the UK average where the 50-59 age group makes up the majority of admissions.

There were triple digit percentage increases in self-pay admissions for all except the 20-29 (77%) and 90-99 (60%) age groups. In contrast only the 0-9 (225%) and 80-89 (111%) saw such increases for insured admissions.

Insured admissions were down in the 20-29, 30-39, 40-49 and 50-59 age groups.

Important notes

All data described above taken from PHIN’s unique, national private dataset describing discharge activity (day case and inpatient). This excludes activity outside of PHIN’s mandate from the Competition and Markets Authority, such as outpatient diagnostics, physiotherapy and mental health services.

There is a time lag between collecting, validating and processing the data we receive from hospitals before we can publish it. This can be up to 6 months after treatment has been completed, to ensure a fair process and accurate data.

Activity numbers have been rounded to the nearest 5, with percentage based on the unrounded figures.