In a column written for the Healthcare Markets Magazine, PHIN's member services director, Jonathan Finney looks at the completeness of the data being submitted by hospitals and fee information by consultants in line with the Competition and Markets Authority’s (CMA’s) requirements.

The CMA’s Private Healthcare Market Investigation Order (the Order) set out to achieve: ‘lower prices, higher quality or greater choice of private healthcare services in any market for private healthcare services in the UK’[1]. To help patients make more informed choices and providers to continuously improve services, it is vital that we have as complete a picture of the market as possible. That means collecting accurate and timely data, and publishing it in an appropriate manner.

We’re very pleased with the progress being made by the independent sector and grateful to everyone who is contributing their data to help us achieve this aim. For example, as at the end of May 2023, we have participation from 583 sites, and 75% of consultants are submitting their fees (over 60% have also uploaded profiles and/or entered procedure details). 513 sites are on our website along with more than 9,600 consultants. We’ve also seen the highest ever volume of Patient Reported Outcome Measures (PROMs) submitted at over 39,000. All this data plays an important role in helping patients to make more informed healthcare decisions.

While there has been great progress as a sector, there is always room for improvement both in terms of completeness of data and data quality. For example, full data submission from NHS Private Patient Units (PPUs) has not yet recovered from the pandemic and continues to fall behind the majority of independent hospitals. While PPU activity represents a small percentage of the market, it includes nearly 300 hospital sites.

At PHIN our goal is to always encourage compliance through positive engagement. We’re here to support all hospitals and consultants to help them meet their compliance obligations. This includes regular communications, invitations to introductory sessions and even the occasional visits.

Although our approach is always to help and avoid anyone coming to the attention of the CMA, we recognise that this is an important part of the compliance process, when positive engagement does not have the desired outcomes. We have therefore established escalation pathways for both hospitals and consultants. These have been agreed with the CMA.

Enforcement proceeding are underway

It is over six months since the CMA announced it would be taking enforcement action with those providers and consultants who were not engaging in the data submission process for submitting fee information. This was no idle threat as in April 2023 the CMA wrote publicly to two private hospitals (the Ulster Independent Clinic and the Fortius Clinic) after their failure to provide data for publication on performance and patient outcomes. We have continued to support both providers which have since produced a plan to achieve compliance within six months, but if this is not fulfilled, then the CMA can take further enforcement action. A similar process has been in place for consultants, but so far all those referred to the CMA have responded well and submitted the required fee information.

The CMA is now working on further escalations for hospitals and consultants. As we approach the Order deadline of October 2026, the likelihood of escalation only increases.

Hospital escalation

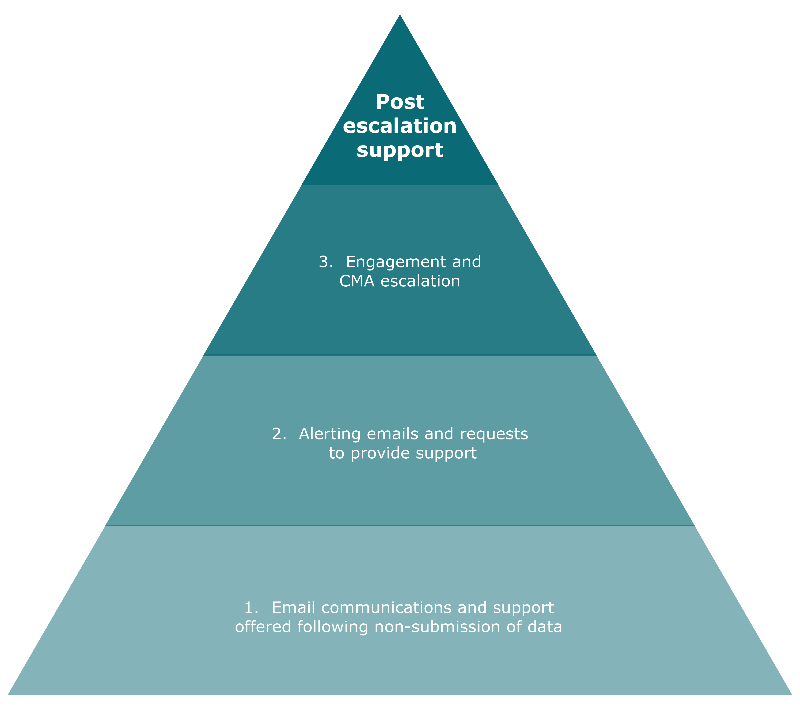

We have an established process to ensure sufficient opportunities are given to avoid escalation, and to provide a fair and transparent basis for any subsequent procedures to take place.

Prior to escalation providers receive several non-compliance CMA escalation emails, data reminders and compliance email campaigns and are offered opportunities for support meetings. This is in conjunction with business-as-usual engagement activities to ensure compliance is achieved and maintained.

Initial warning emails highlight that data has not been submitted along and offer support. The next stage involves giving notice of potential escalation. This is then followed by the letter from the CMA giving notice of escalation.

Final warning emails highlighting imminent escalation to the CMA will be sent from PHIN’s CEO to provider executives, as well as their appointed PHIN responsible officer. Once again this includes offers of assistance.

If there is no progress, the provider will be referred to the CMA for enforcement action. We will offer post-escalation support and monitoring to help ensure future compliance.

Variation for PPUs

Overall, the escalation for PPUs at NHS sites is the same as for independent providers, but we are making additional efforts to engage senior management at Trust/Health Board level, as well as NHSE or equivalent body in the devolved nations.

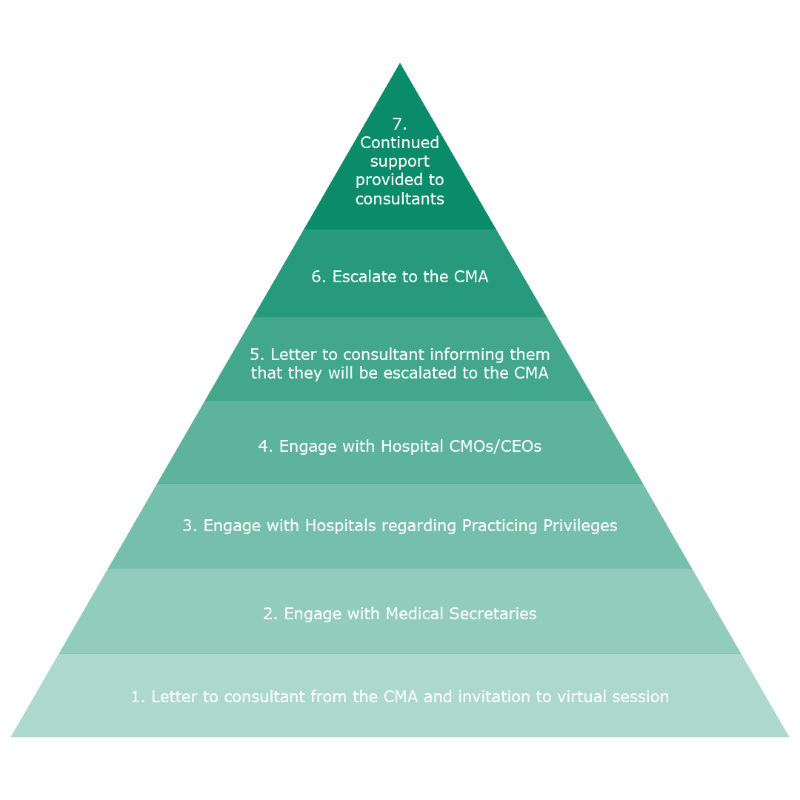

Consultant escalation

We are committed to working with consultants to offer support to fulfil their legal obligations under the Order. This involves offering support with accessing and using our consultant portal by inviting consultants to introductory sessions, checking with medical secretaries to ensure contact information is accurate and requesting confirmation from hospitals to ensure that consultants continue to have practising privileges/ employment at hospitals. We also engage with Chief Medical Officers to seek their support in prompting consultants to fulfil their obligations.

As with the hospitals, we only escalate consultants to the CMA when these processes are exhausted, and we continue to offer our support after the escalation has been made.

Additional benefits of compliance

Compliance with the Order is not all ‘stick’ and no ‘carrot’. As well as the benefits to patients in having the information available to them to inform their treatment choices, there are benefits to providers and consultants of being published on the PHIN website. Over the past year (June 22 to May 23) there were an average of 6,550 contacts made each month to hospitals and consultants who have a profile on the website. This was at its highest yet in March 2023 when 11,700 contacts were made. Our analysis shows that those hospitals and consultants providing the most complete profile information receive the majority of the contacts.

If you have any questions about compliance or our website then the team at PHIN would be delighted to hear from you. By working together the sector can show the real picture of private healthcare in the UK.

1. Paragraph 8.1 (a) (i)